Why VCs Are Always Right (Even When They're Wrong)

Build a sustainable company or grow your valuation. Your choice

*Word count: 2000. PS: There’s a request/announcement at the bottom of this. Stick around and see you in the comments.

Congratulations to the Super Falcons for being ten-time champions of the Women’s African Cup of Nations

Congratulations also to the Nigerian Women's Basketball team, D’Tigress, for winning the African championship for the fifth consecutive time, making them seven-time champions overall

Emperor Jamie Dimon is single-handedly trying to reverse open banking, and there’s nothing anyone can do about it. Here’s hoping his Nigerian equivalent (yes, you know his name) does not start getting the same funny ideas

MTN Ghana recorded a higher profit than MTN Nigeria in H1 2025 for the first time, despite having 50 million fewer customers

Figma had a successful IPO, leading Bill Gurley to launch his usual rants whenever an IPO is underpriced. Brian Armstrong made another call to launch IPOs on-chain for better price discovery, and oh, Lina Khan is taking a victory lap for the IPO. Talk about survivorship bias. The dead bodies of iRobot, Spirit Airlines, Windsurf, Scale AI, Figma employees of 2022, Plaid and many others aren't even cold yet.

And now let’s talk about VCs

YC has just released its latest call for startups, notably asking for the first 10-person company valued at $100 billion (since Instagram doesn't count). It led me to dig around, confirming a theory on how they revise their call for startups, and by extension, fund conviction every quarter, often even going a full 180 on ideas they had promoted just a quarter ago.

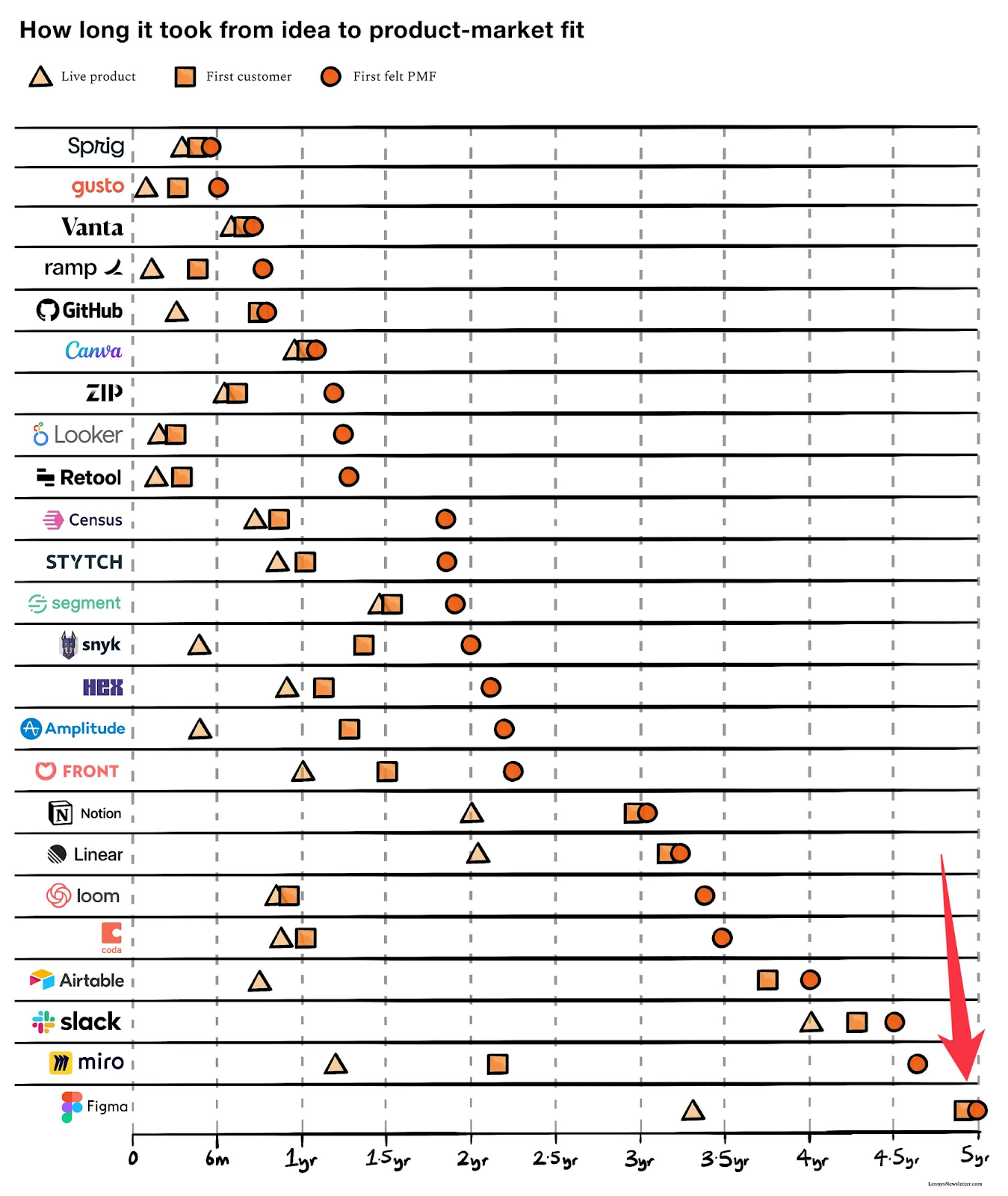

This is one reason founders today struggle to build conviction: because those funding them also do not have conviction. In a world where fictional 30-day, $100 million MRR companies are now the norm, Figma needing five years to hit product-market fit is a reminder that building is a slow process

Marc Andreessen believes VC is the last job AI will replace. While that's the classic "talking your own shop and hoping your job is safe from AI," he may be right, because VC is not a real job. VCs meme themselves into relevance and irrelevance with the same copycat play of not knowing what they're doing

But first, what is a VC, and how do they differ from private equity

You Can't Prove a VC Wrong

You have seen this before - founders who get rejected by VCs wanting to show them by being ultra successful. Kinda like how Vini Jr declared: “We’ll do it 10x” after getting snubbed by the Ballon d’Or, then proceeding to do worse.

The truth is: it is almost impossible to prove a VC wrong. The structure of their work means they do not learn from their mistakes or self-correct. Just as you can’t prove that your friend with a gambling problem wrong, VCs elevate the gambling stakes by cosplaying as finance professionals in Patagonia vests.

VCs aren't looking for a guaranteed reward. They're gambling on over 50x returns where losses don't matter. Their power Law, where 1 in 20 investments returns the fund, incentivises growing valuations at all costs, such that losses they make do not matter

How can you prove an entire industry that believes and lives by that statement wrong? You can’t because even when they lose, they win

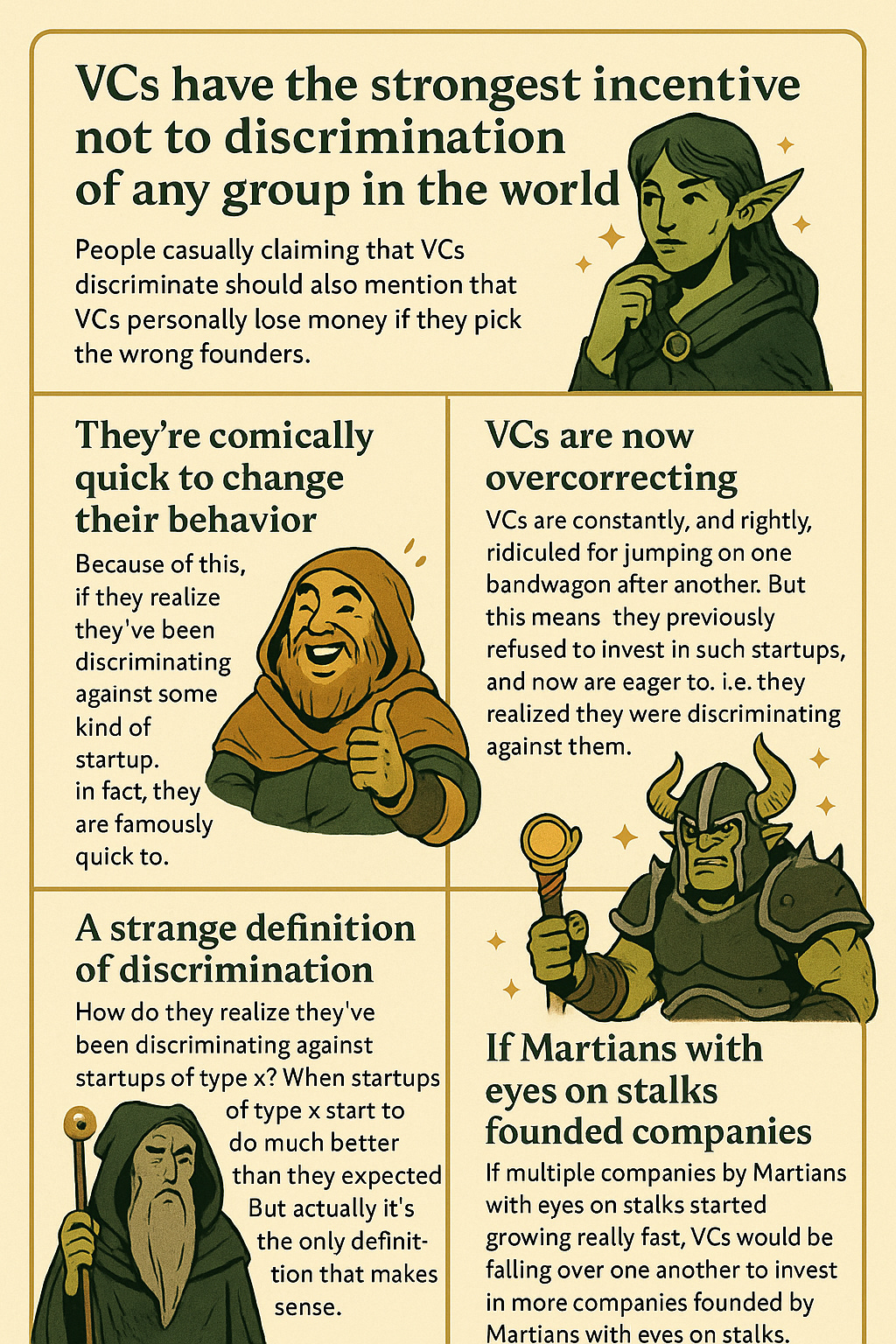

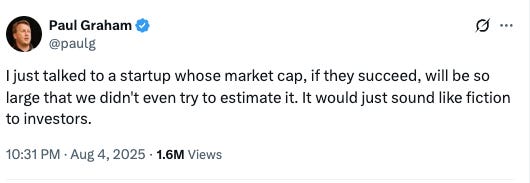

Paul Graham insists VCs have the strongest incentive to be objective. Ironically, his argument is exactly why they do not learn the right lessons.

It all starts with the types of venture-funded companies today. They are businesses that need venture capital to get off the ground, and can only possibly become unicorns based on the thesis of the day. Thanks to the AI hype, the minimum requirement these days is decacorn potential.

Most founders pursue ideas that require patient VC money to work. If VCs don't back you, you'll never reach the outcomes that might prove them wrong.

So when next VC-backed companies fail, don't blame VCs for ignoring sustainable $20K/month businesses. They've priced in that loss. Sustainability isn't what they are looking for, no matter what their blog posts say. [You can watch Dr. Ola Brown’s video for more on this here]

They mostly care about if and by how much you can multiply your valuations, because that's how they measure success and justify their carry (usually 20%) to their LPs. In simple terms, they get paid their salary by multiplying valuations, not by funding sustainable businesses.

This is why the VC gospel is fleeting and inconsistent. They're gambling, and they are the house that always wins.

Gaining Consensus

Say you're a founder who has read all this and decided you still want to play the game. It's not even about finding that one VC who will believe in you. A series of VCs need to believe in you for you to reach the VC outcomes that matter today.

The VC economy depends on consensus. VCs know this and index for it. It's why they're constantly asking founders who else they're talking to and tailoring what they do to match these other VCs. (Due diligence? Lol, forget about it.)

Once VCs set their minds on an idea, nothing, including common sense, will stop that business from making it to Series E.

The founder’s job here is not to show traction. It’s to convince VCs you’re building a unicorn. That is the most important part of winning the VC game.

And yes, belief does not equal success as VC-backed companies typically don’t outperform others in the long run on the real metrics that matter. But belief is essential if you want to raise.

When a VC evaluates a company, regardless of how much they like the founder, industry, or company, they ask one question: What's the probability this returns desired multiples through a higher round, acquisition, or IPO?

It is the founder's job to paint a picture of any of the three, and it is a painfully hard job to do.

The industry runs on the bible of Paul Graham, and as he said, Startup = Hockey stick growth. That means growing customer, vanity/activity metrics and valuation numbers are more important to them than revenue and profit. This is what Russ Hanneman tried to explain to the Pied Piper founding team in this scene from Silicon Valley.

For context: most startups close the next round roughly within two years, strategic acquisitions tend to happen around years five to seven, and the median time to IPO has now stretched past six years. Investors, especially early ones, are more likely to get exits from a new raise than an acquisition, and very few wait for an IPO that may never come.

To get funding conviction faster, VCs look for patterns that they have seen work in the past: type of company, founder pedigree, and market opportunity.

Type of company

Paul G is not entirely wrong here. It's simply that he’s sharing a limited perspective we have to delve into.

If there were competing philosophies in the VC ecosystem, his statement would be true. One group can pass on a startup, leading another group to back it. Some would be wrong. Some would be right. Lessons would emerge, and those who missed the rocketship will overcorrect.

In practice, however, the VC hivemind focuses on hot industries. VCs are currently laser-focused on AI, while all other categories take a back seat because no consensus has been built around them.

The playbook hasn’t changed. Grow fast, burn cash, crush competition, then raise prices. It's a strategy that's worked before, with VCs happy to keep funding discounted prices until all the competitors are gone, leaving users no choice but to pay the regular fees. (The median basket size on Uber Eats used to be $9; now it's $36)

We’ve seen this cycle: ride sharing, food delivery, free banking, e-commerce, and cloud storage. Now: AI, stablecoins, cross-border payments.

The hope? Grow fast and get more funding (OpenAI). Scare incumbents and get acquired (FB<>Insta/Snap, Adobe<>Figma). Build hype and get Wall Street to send your IPO to the moon (Circle, Zoom).

Founder pedigree

“Tell me about a time you hacked a non-computer system to your advantage” - YC application form.

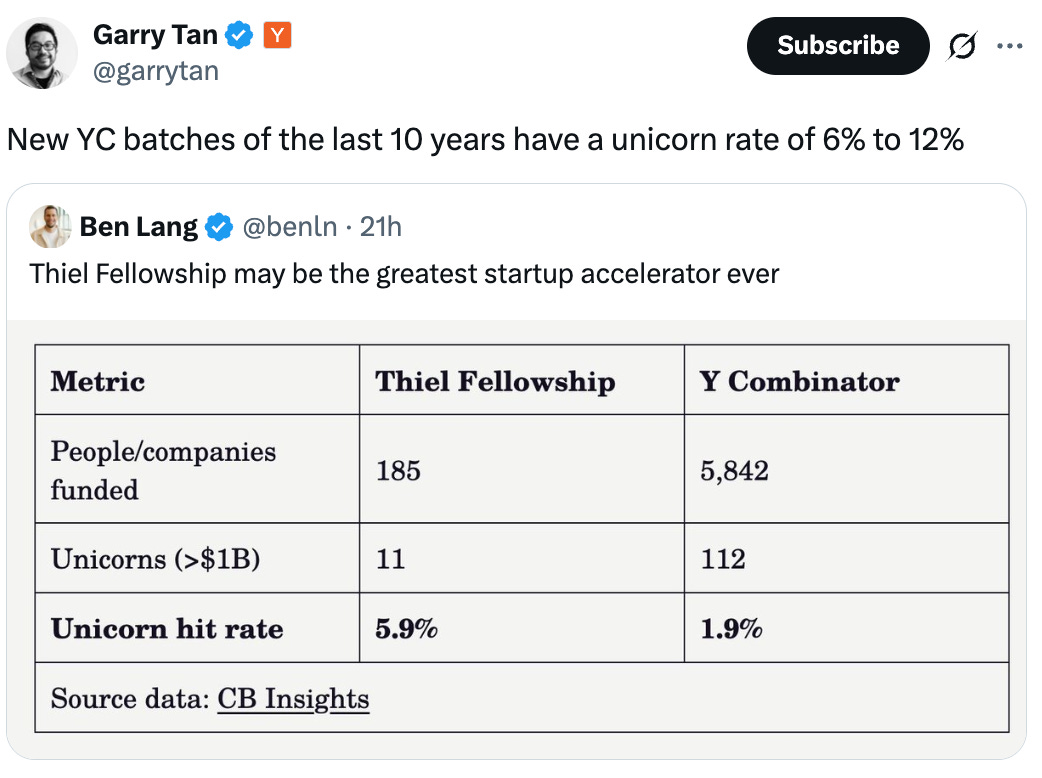

Recently, Garry Tan (the current YC President) said YC backs underdogs when discussing the founders of Kalshi, who had studied at MIT. This caused just about the predicted uproar, as it is further proof of how these folks can’t even see it and will never learn.

They believe they do not discriminate, yet they pattern match for the same kind of founder and behaviour, which they claim they are blind to.

Let's make a list of the profiles of a few of the latest VC darlings

Multiple-time accelerator dropout

Former startup founder who grew a product to 450K users

Viral founder expelled from MIT

Former romantic partner of a prominent VC

Early employee of a payments company

Stanford dropout

VCs tend to fund the same people repeatedly, but their pattern matching isn't irrational to them. They're hunting for signals of founders who can deliver >50x returns.

Sam Altman is probably the greatest fundraiser of our lifetime, besting even Elon by driving OpenAI’s private market valuation to $500 billion. He is a Stanford dropout and a failed founder who has been fired twice, and his legacy is YC’s fundraising engine.

This is the profile VCs seek. Among 10 founders starting the same company, who's most likely to be smart, tenacious, and connected enough to make things work? Who has insights their competitors lack?

This is how they define 'genius,' and they pattern-match for these qualities.

This is why VCs fund people more like them, and certain demographics get less money.

It's super tough to convince an investor like Marc Andreessen that a UNN grad is the next unicorn, or that you can build a data annotation company from Nigeria when they can’t spot a founder who has already hit it big in the same market. It’s the same reason lads in New York who have never experienced currency volatility in their lives are raising money for the same Stablecoin ideas that Fluidcoins and Lazerpay got shut down for

Diverging a bit, we need African funds to scale and grow outside of the local markets, despite our economic climate

The African unicorns who have raised single $100 million rounds shift the entire ecosystem because VC logic is basically - when you back prestige, you get more prestige.

So when VCs hyper-focus on funding founders with prestigious logos on their CVs, they're only ensuring that more of those people than usual will have a chance at success.

This inevitably forces VCs to look more kindly at liars founders from those backgrounds. Leading to their over-representation in bigger rounds. To whom much is given, even much more is given when they show workings - Parable of the talents.

This ties back to how difficult it is to prove a VC wrong. Underrepresented founders need to somehow succeed massively without funding, get press that's only easy when you're in the ecosystem, and do so in numbers large enough not to seem like a fluke.

Market opportunity

Market opportunity is the final filter. To justify every venture funding, an exit large enough to justify every cheque in the fund has to be dangled so partners can reverse-engineer the simple question: can this market support several billion dollars of enterprise value within a decade?

Every VC pitch ends with the same math: TAM size, your share, customer spend. Then they subtract regulation, friction, and education.

So when a VC asks for your plan on reaching $100 million ARR, it's not cliché. They are asking you to help them build a framework for what it takes to be a unicorn, and if it's more than what they think the market can support, they move on.

This is the final important but connected criterion that keeps VCs away from objective reality.

The Self-Fulfilling Prophecy

The VC consensus here is a self-fulfilling prophecy. If VCs believe AI is the next big thing, they are powerful enough to make it the next big thing.

If VCs back only white women in Utah disproportionately, unicorns will eventually appear there in larger numbers than elsewhere. Then VCs will look at women from Utah more favorably.

We've seen this with food delivery, online marketplaces, fintech, payment orchestration (lol), and now stablecoins, cross-border payments, and multi-currency accounts.

When VCs fund free value, consumers jump. That’s how Chat GPT, Cursor, Uber and the food delivery companies of the world grew. The VC's belief in a market will subsidise the provision of free value for years.

So when they’re right, they’re only right because they made it true. Which raises the question: What about everyone else

The Alternative - Invisible Success

Successful founders and industries that never raised venture capital still exist (37 Signals). But unless you have a DHH-level tendency to go to war on the internet, the VC and larger media ecosystem won't even see what you've done.

If TBPN, The Information, The WSJ, TechCrunch, Techcabal (or any other tech press that starts with “T”) does not break the news about your company, did it really happen?

It’s not only that your personal smaller success is not impressive compared to other VC-backed startups that they look up to, but that they’re not going to know that you succeeded.

Heck, the media and those of us who write for clicks know this too: I’m more likely to get more views on this by name-dropping Flutterwave, Moniepoint, and OPay than by mentioning Interswitch and Systemspecs(Remita), despite the latter two powering the nerve centres of the Nigerian financial ecosystem.

The CEO of Surge, a ScaleAI competitor, was recently interviewed on 20VC. Despite Surge's superior revenue and data annotation impact, the company and its founders are classified under the “unknown” category, while Alex Wang is celebrated as the world's youngest tech billionaire. This highlights how overlooked and unseen non-VC-backed categories and founders are.

VCs need to boast about being your first investor after you hit a major milestone, and success can indeed be an orphan for non-VC-backed founders.

This doesn’t mean that profit or revenue-making is bad. Heck, I love good old sustainability. But what VCs want isn’t always what keeps a business alive. The key is figuring out where your specific business model and strengths fall on the spectrum and striking a balance, as Ecclesiastes 3 advised.

A time for growth. A time for revenue. A time for efficiency.

Some companies are better off ignoring VCs, chasing revenue, and then exploring other capital sources like debt and private equity.

Frankly, PE-backed outcomes are often better. PE firms take long-term views, go hands-on, and back real businesses. The market creation outcomes of MTN and Interswitch outpace those of Flutterwave, Jumia and Andela.

You can't prove a VC wrong. But you don't always need to prove them right either.

** This post was written in collaboration with two people who have been on both sides of the VC transaction. Thankful for their patience, feedback, time, and knowledge in contextualising and clarifying multiple things regarding this topic.

** PS: The next topic I want to write on is Stablecoins. But I want to ask the readers of this first. If you had to read only one article on Stablecoins, what would you like to know? Which questions do you think the current literature on Stablecoins has yet to answer? Please let me know in the comments. Thank you.

Who wins: Fiat-backed vs crypto-collateral vs. algorithmic stable coins?

There’s no consensus (yet) on which model can truly scale globally without failure.

Your piece reminded me of an Epigraph from The Power Law

"John, venture capital, that's not a real job, it's like being a real estate agent."

Intel's Andy Grove addressing John Doerr