No More Dirty Money: Nigeria Exits the FATF Grey List

How we got on, how we got off, and what it means for fintech - Now the real work begins.

Hello again,

OpenAI has a new ownership structure as a Public Benefit Corporation

Paxos accidentally invented $300 trillion on the blockchain

Moniepoint raised an additional $90 million to close its Series C round

The CBN releases yet another guide on agency banking and ATM deployment

Dear Stripe 2021 Facebook called, they want their Libra back

There is a New bill for Fintech regulation in Nigeria

On 24 October 2025, the Financial Action Task Force (FATF) came bearing gifts for the Nigerian market by announcing that Nigeria (along with South Africa, Mozambique, and Burkina Faso) had been officially removed from its “jurisdictions under increased monitoring” list, otherwise known as the grey list.

After nearly three years of reforms, countless reports and examinations, Africa’s largest economy has taken a giant step towards restoring its credibility in the eyes of global investors, banks, and fintech innovators by officially getting off the naughty list.

But what does this actually mean? And more importantly, will Mercury finally let us open accounts again?

What Is the Grey List?

The Financial Action Task Force(FATF) sets global standards for fighting money laundering and terrorist financing across the world. Part of their job includes evaluating countries, scoring their AML/CFT regimes, and telling the world who’s compliant and who’s not, and to what degree.

The grey list is their polite way of saying: “Buyer beware” or “we’re watching you.” Not quite sanctions, but countries on it have “strategic deficiencies” in their anti-money laundering (AML), counter-terrorist financing (CFT), or counter-proliferation financing (CPF) frameworks.

Being on this list means increased international scrutiny as global banks and investors treat you, your citizens, banks, neobanks, stock market, remittance providers and international merchants like a risk, leading to enhanced due diligence, frozen partnerships, restricted accounts, etc.

In simple terms, all those tweets about PayPal, N26, Mercury, a random bank in a random country, not allowing Nigerians to open accounts or receive money from Nigeria, are a result of the increased monitoring Nigeria was under due to our lax AML practices

(The only thing worse than the grey list is the black list, but that’s a story for another day.)

So How Did We Get Here?

Nigeria’s experience with FATF isn’t new. The country’s journey towards financial integrity stretches back two decades.

The First Listing: 2001–2006

Sadly, this isn’t our first rodeo with the FATF. Back in 2001, Nigeria was labelled a Non-Cooperative Country and Territory (NCCT) under the FATF’s old version of the grey list. Citing the same problems: weak AML enforcement, poor supervision, and zero political will to correct the situation.

In response, the Obasanjo-led government enacted the Money Laundering (Prohibition) Act 2002, established the Economic and Financial Crimes Commission (EFCC), and later created the Nigerian Financial Intelligence Unit (NFIU).

By June 2006, FATF removed Nigeria from the NCCT list after recognising “significant progress” in institutional reforms. - Shout out to Okonjo-Iweala.

Between 2006 and 2023: Two steps forward, one step backward

For nearly two decades, Nigeria stayed off the FATF list. But GIABA(Inter-Governmental Action Group against Money Laundering in West Africa) — the regional West African FATF body- kept us under continuous monitoring.

Their reports weren’t exactly glowing as they cited weaknesses and gaps in our enforcement practices. Beneficial ownership problems and the non-bank financial sectors were largely left unsupervised.

Beneficial ownership problems (no public register, no valid way to know if a company was owned by a politician, terrorist, or someone’s cousin’s shell company - Think Kola Aluko, Jide Omokore and Dieziani Allison Madueke).

On the plus side, this was also Nigeria’s golden era for financial services: LSE listings, payment unicorns being created, overseas-based funds pouring capital into the NGX, global banks expanding into Nigeria and providing capital for infrastructure projects and syndication of loans. We were building a specialised financial system up until….

The 2023 Grey Listing

When the FATF released its 2021 Mutual Evaluation Report, Nigeria had addressed 69 of 84 identified actions but fell short on 15 strategic deficiencies. With no political will to address these deficiencies, the FATF placed Nigeria on the grey list again in February 2023 for the same old problems 🤦🏾♂️:

Incomplete beneficial ownership data

Weak oversight of designated non-financial businesses (most especially real estate, gambling and legal services)

Government agencies that didn’t talk to each other

Near-zero money laundering prosecutions

Oh, and those news reports about paying kidnappers, government officials funding Boko Haram, and granting amnesty and cash swap deals to terrorists certainly did not help our case.

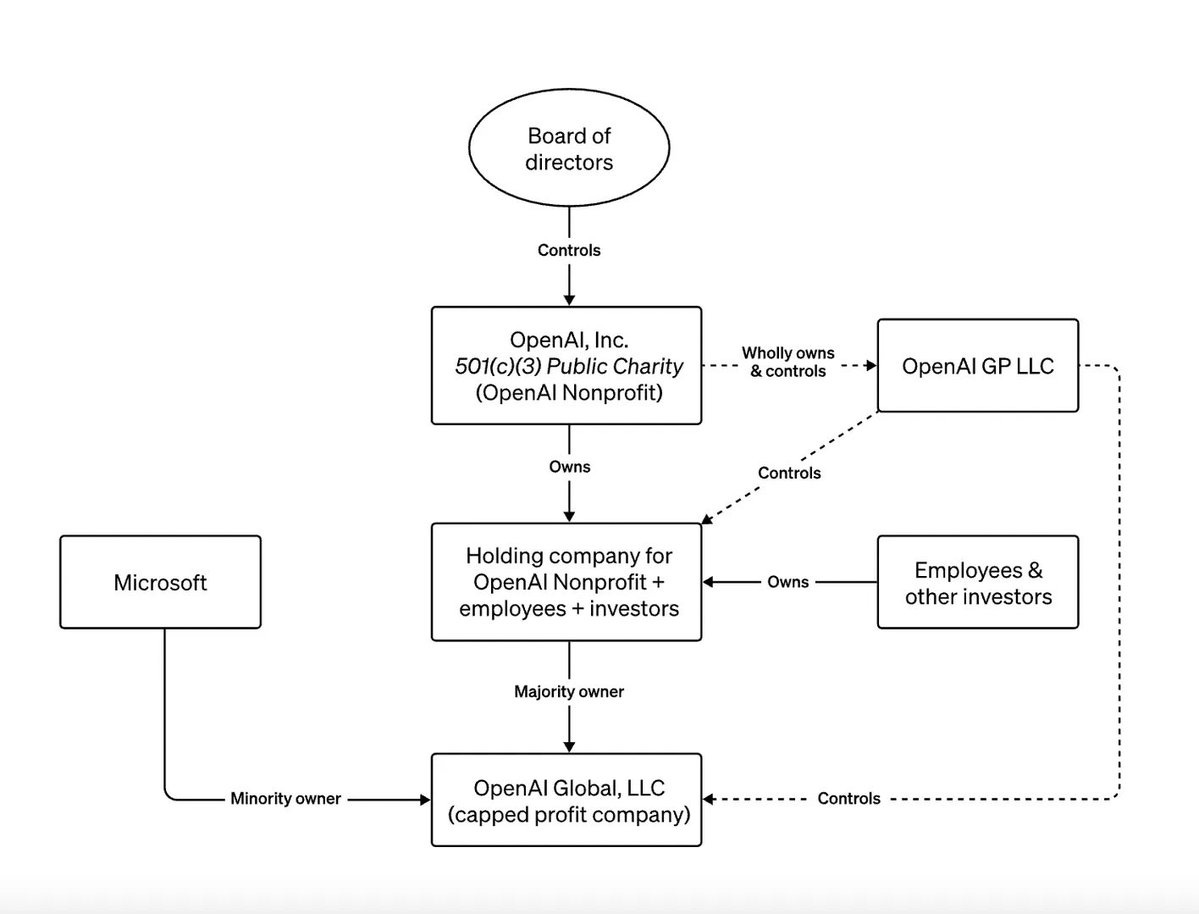

It’s also funny how we’re on the grey list for complex UBO laws when OpenAI, the most valuable private company in the world, has an ownership structure that looks like this, but I digress.

The Economic Toll of Grey-Listing

Anyway, what did we learn from being grey-listed, and why was it so important for us to get off the list?

The grey-listing had immediate and measurable consequences for Nigeria’s economy along the lines of:

Capital Flight and Investment Decline

According to an IMF study, grey-listing reduces capital inflows by an average of 7.6% of GDP across affected countries, largely due to higher compliance costs and de-risking behaviour from global banks. For Nigeria, this translated into tangible losses in foreign direct investment as Nigeria’s FDI fell sharply, hitting $29.83 million in Q2 2024—the lowest in a decade.

Banking and Transaction Costs

Regulators classifying Nigeria as a ‘higher risk’ country meant increased due diligence for financial transactions. This meant:

Enhanced due diligence requirements from international banks

Higher compliance costs for cross-border transactions

Slower processing times for international payments

Inflated transaction fees for businesses and individuals

And as leaner fintechs were spinning up globally, the cost of compliance to service Nigeria and Nigerian citizens became too much for many of these businesses, leading to mass debanking.

Reputational Damage

Risk classification by global institutions, payment platforms (hello Stripe and PayPal) and card networks led to higher transaction costs, fewer partnerships, and reduced trust across the ecosystem.

(Hopefully, someone smarter than me responds to this with how, despite acquiring Paystack, Stripe still does not deem it fit to extend their services to Nigeria)

Grey-listing, in essence, multiplied the existing friction Nigerians already faced when trying to transact globally. And the fault was squarely laid at the feet of the government.

How to Get Off a Grey List: 234 Edition

After grey-listing in 2023, FATF handed Nigeria a 19-point action plan to implement and follow if she wanted to get off the naughty list. Some of the key reforms included:

Legislative Overhaul Money Laundering (Prevention and Prohibition) Act and Terrorism (Prevention and Prohibition) Act, both passed in 2022, provided the legal foundation.

The Beneficial Ownership Register was introduced to bring corporate transparency and traceability of assets.

Institutional Reinforcement Strengthened NFIU coordination and data-sharing between EFCC, CBN, and security agencies. Finally, Nigerian government agencies agreed to start talking to each other.

Supervision of Designated Non-Financial Businesses and Professionals(DNFBPs), New compliance audits for real estate, legal, and the gambling sectors.

Increased

politicalProsecutions, heightened enforcement and conviction rates for AML/CFT violations. Turns out, arresting people for money laundering helps your money laundering statistics.

What this actually means for Nigeria

Nigeria’s removal from the grey list signals to investors and counterparties that its financial system has met the world’s highest integrity benchmarks. (On paper, at least.)

Some of the early benefits we should see include:

Investor Confidence Restored Market analysts expect stronger FDI and portfolio flows, especially into fintech, banking, and digital services.

Correspondent Banking Relationships: Global banks are more likely to reopen and expand cheaper lines with Nigerian counterparts. This is huge for trade finance and international payments.

The Naira... might strengthen? Confidence may help stabilise the currency, encouraging inflows through formal channels. (See, we have to say every good thing could lead to a stronger naira. It’s the law.)

Improved Sovereign Ratings: Moody’s already upgraded Nigeria to B3 in May 2025. Lower compliance risk means cheaper borrowing long-term.

Fintech Opportunity Partnerships with global players become easier. Nigerians banking globally becomes less impossible. (caveat: this last one will take time to materialise, so don’t go opening an N26 account yet)

Cross-border payments should get faster, cheaper, and less painful. International transactions should feel like local transitions, and trade finance processes will require less complexity.

For foreign investors, Nigeria shifts from “regulatory nightmare” to “manageable risk.” as Due diligence gets easier, portfolio investment and private equity become viable again, and the young Nigerian Investment bankers who have been doing boring CP deals for 5 years are back in the game of structuring complex big ticket transactions like their mates in Canary Wharf, Dubai, Switzerland, and Wall Street.

Post-Delisting Reality: Not so fast

Partner Content: With Nigeria’s recent removal from the FATF grey list, the regulatory landscape is changing. For companies looking to expand, compliance is now more critical than ever.

RegentComply’s AI-powered assistant helps companies in all jurisdictions scale their compliance readiness processes faster and more affordably—without relying on expensive consultants.

See how it works at RegentComply.ai.

Whilst the delisting is a breakthrough, practical change will be gradual. Many global institutions update their global compliance frameworks only after sustained observation. Banks, neobanks, and payment networks still have to conduct their own internal reviews and regulatory updates before easing restrictions, depending on their defined risk appetite.

It’s exactly as Nigerian politicians say - “These things take time”

Nigerian founders, freelancers, and digital entrepreneurs should still expect the challenges they face today, such as “debanking”(not a real word, I am sorry), and potential fraud flags on their transactions from Stripe, PayPal and the global players.

Yes, the FATF delisting has removed a structural barrier, but our reputation has taken multiple hits that would take time to wash off. Even if the paperwork says we’re clean, the market still remembers the mess.

Nigeria has been placed under a 12-month post-observation period by FATF. This means we need to prove that these reforms translate into sustained enforcement, not just temporary compliance eye service. The next Mutual Evaluation in 2027 is our real test.

We have signalled to the world that we can meet global standards when we actually try. Hopefully, we can maintain it and not screw this up. The financial services economy, the IPOs of the future and the careers of Nigeria’s youth depend on this being a real, sustained thing.

Goodluck

"(Hopefully, someone smarter than me responds to this with how, despite acquiring Paystack, Stripe still does not deem it fit to extend their services to Nigeria)"

I've been asking this question for years now. Yearssss