Creating the Future? Thoughts from Money 20/20, Stablecon and London Tech Week.

Africa Solved Real time payments first – The world still doesn't know it.

June is usually Fintech event season with conferences like Money 20/20, Stablecon, Vivatech, London Tech Week, and the Africa Tech Summit all kicking off the month.

I was privileged to attend the Money 20/20 conference this year as part of the RiseUP/Amplify programme, under the theme “create the future”.

I asked friends who attended the other events for their insights to see if common themes emerged across the circuit. So here is the event breakdown on all things stablecoins, AI, cross-border, real-time payments, fraud, and so much more.

On Stablecoins and Regulation

The EU’s PSD2 may be the most democratising piece of banking regulation ever created; it opened up the financial landscape in ways we are still discovering, enabling companies like Wise and Revolut to scale seamlessly across Europe with one licence. The consensus on the floor is that MiCA and the GENIUS act would do for Stablecoins what PSD2 and the Durbin amendment did for the neobanks.

I have always believed that stablecoins need better marketing beyond the tired “cross-border and cheap fees” pitch. Chris Dixon’s framing of stablecoins as “the WhatsApp moment for money” finally made a significant dent in changing the narrative to something relatable. Cross-border payments and cheap fees are not a mainstream moat because the Ideal returning consumer of financial services products (who you will earn fees and sustainable income from) does not care about all that. Only insiders and hobbyists do.

Stripe’s CTO called Stablecoins “real-time global financial text messages,” exactly what SWIFT and Bloomberg market their platforms as. Are you following the thread here?

Institutional Money Movement Opportunity

The biggest takeaway from Stablecon? The real impact will be felt on the infrastructure and institutional side, not the consumer.

We are talking about creating infrastructure for local financial accounts, global treasury services, and powering real-time money flows in global marketplaces. Cross-border payments will eventually get commoditised. It is cute now that I can send money to my Airbnb host in Nairobi via stablecoins, but if they have to off-ramp to withdraw Shillings, they will charge me more for using stablecoins.

Here is where I believe stablecoins will shine: institutional treasury optimisation. Banks and big companies constantly get burned playing treasury games. JP Morgan is experimenting with blockchain to settle custodial asset transactions faster. RTP, Open Banking, Stablecoins, and AI, all four, must work together for new-age treasury optimisation. Missing even one makes the entire exercise futile.

Global stock market transactions still settle on a T+2 or T+3 basis. This is where stables should target, not retail consumers who largely do not care about fast cross-border settlement

The CEO of Airwallex kick-started a few difficult conversations recently on the reality of these topics.

TL: DR - Stablecoins are a rest of the world innovation being built and promoted by US-based entities. Trying to offramp and provide liquidity to any currency outside of the G20(exotic currencies) is a loss-making philanthropic venture that needs to be subsidised by distribution(Coinbase + Circle) or “Innovative business and accounting practices”(Tether)

While on the topic, congratulations to Circle on its IPO. The issuer of USDC now boasts a larger market cap than USDC itself. Up next, surpassing the market cap of its distributor, Coinbase.

The banks were notably absent from Stablecon. - Draw your conclusions here.

AI and Fraud: The Double-Edged Disruption

Stripe’s CTO seems to think AI might be the end of SaaS as we know it. Meanwhile, we are facing a sobering reality about fraud: we cannot compete with AI-based fraud for one simple reason: fraudsters are highly adaptable, evolve constantly, and share information at a scale we do not and cannot match.

The developed world will see AI enhance customer service and optimise financial operations. Emerging markets? Lots of re-education needed, as we are building faster ways for humans to lose money, then blaming them for it.

Just like AI will cannibalise human workers, the need for faster payments will destroy the fraud prevention gains we have earned in the industry. Maybe we should prioritise friction and delayed transactions instead of racing towards making every transaction instant.

We are not prepared for AI in the hands of fraudsters – sextortion, deepfakes, revenge porn, and blackmail. But we can contain the risk before the next AI casualty empties their accounts, thinking they are dating Brad Pitt.

Marketing, Branding and Messaging

In another timeline, embedded finance would probably have been called AI finance and gotten more investment and attention. “Seamless and smooth + at the point of need” – what is not to love? The branding and timing of fintech concepts matter more than we admit.

Speaking of branding, merch is important. Visa and Papara had some of the most memorable merch at these events, with queues of people missing important sessions just to get their hands on branded F1 cars and personalised NFC contact cards. Sometimes the simplest and most expensive marketing works best.

Everything you know about Klarna, the colours, the AI gaffes, the CEO’s tweets, etc, results from multiple marketing stunts happening simultaneously. They stumbled on a key insight early: the BNPL market, tightly coupled to marketplaces (fashion, makeup, travel), has a female-dominated customer base. They have successfully rebranded fintech from the stereotypical blue, black, AMEX, suits-and-bureaucracy image to a stereotypically pink, female-friendly brand.

“People do not trust banks, but have no choice – might as well make it fun.” - David Sandstrom, Klarna CMO. This insight made me realise how intentionally Nigerian brands like PiggyVest and Kuda have worked on their image to target women.

Finally, I couldn’t help but notice that Simon Taylor, Dwayne Gefferie, Jevgenijs Kazanins, Nik Milanovic, Alex Johnson, Jason Mikula, and Matt Jones, all Substack fintech writers with day jobs, were afforded well-deserved celebrity status at these events. At this rate, the future where industry professionals disrupt industry media entirely and become larger than life brands is a few years away.

Your thoughtful stablecoin newsletter will soon be repurposed as fast-paced AI slop by someone with bigger reach. It does not matter, keep shipping quality content and thoughts.

The Nigerian and African Reality Check

Here is a sobering stat: 30% of immigrant incomes are spent on remittances. Not only is there a market gap here (ensuring immigrants build and retain wealth in their new countries of residence), it is a responsibility we are not taking seriously enough.

The CEO of Nala, and a few folks from SWIFT spoke a bit on the problem of players in the remittance and cross-border space reporting numbers that seem not to correspond with the publicly recorded trends and volumes in the space, and how that causes problems for bigger and well established players when it comes to partnerships, growth and expansion.

Yes, pattern matching when raising funds or seeking out global partnerships is brutal and being told to come back when you start moving $10 billion a month sucks, but hey, inflated metrics make it worse for everyone.

Also, it would be nice if our representatives at these global events did some introspection before speaking on some political issues. If we want to be honest, Africa is a risk. We have to accept it and start fighting it internally rather than externally.

We are on grey lists and visa ban lists for real self-inflicted political and economic reasons. Complaining about the second-order effects of bad government on your business and personal mobility in public does not help when we should be facing our governments for solutions.

Africa needs to celebrate its wins more. We solved instant payments and pay by bank on the continent ages ago, and it sucks that folks are raising money globally to solve problems NIBSS already cracked in Nigeria.

Wero, A2A, Pay by Bank, Pix, UPI – these are fancy names for what our unicorns and legacy companies are built upon. We need to selfishly find ways to own the overall global discussion on these topics, while the rest of the world still plays catch-up.

We have a marketing problem, as we largely still market to ourselves. We do not do enough homework or work on perception building, often starting from base assumptions, expecting audiences to understand the gravity of our innovations.

While many countries showcased their thriving startups with dedicated in-country booths at these events, the presence of CBN and NTA representatives alone isn't enough to positively impact the continent's perception and highlight its financial services achievements. This is where the Minister of Information could have a significant role in establishing a dedicated Nigerian booth for some of these events.

Final Thoughts

Open banking in Europe is fragmented because banks treat it as a compliance project. The poor API reliability speaks volumes about the level of European bank investment. They should switch to a customer-centric approach to drive revenue, and I believe this is the next global trend Africa can take the lead on, as shared here by the folks at the Open Africa Pod.

Regulators seem more willing to cross the pond and engage on these developments than builders seem to give them credit for.

CBDCs are terrible, obviously, but politicians are wary of a certain man residing at Pennsylvania Avenue, and his continuous meddling with the global world order. Protecting digital sovereignty seems to now matter more than owning an additional $2T in US treasuries, even if that is the best solution.

Payments have become less expensive over the past decade, yet those within the industry seem to believe the costs are still exorbitant and should ideally be eliminated, along with an increase in speed. I wonder how we would pay salaries and have proper AML checks when transactions become even faster and cheaper.

Across the pond, the general sentiment is that the crypto industry and real-time payment solution promoters are perceived as pompous saviours. This disconnect from the real world is believed to be a contributing factor to why these solutions have not yet achieved global scale.

Speaking of disconnect, I learnt that not only do we have poor female representation across the financial services industry, but the perspectives of women, children, and the elderly are often neglected in the design of these products. Every finance or finance-adjacent product you use is hyper-optimised for the average 24-45-year-old techno optimist upwardly mobile (usually white) man. The fact that women, children and old people use these products is an afterthought and aftereffect

JP Morgan had a moment where they reminded everyone that they are the biggest payments company in the world. Adyen is for enterprise, and Stripe is for geeks and SMBs. JP Morgan is for serious adults. Just don’t tell Paul G that.

Last year, the most common things heard on the floor were infrastructure, open banking account-to-account and regulation; this year, it was stablecoins and AI. Next year, I hope it's Agentic commerce and MCP servers.

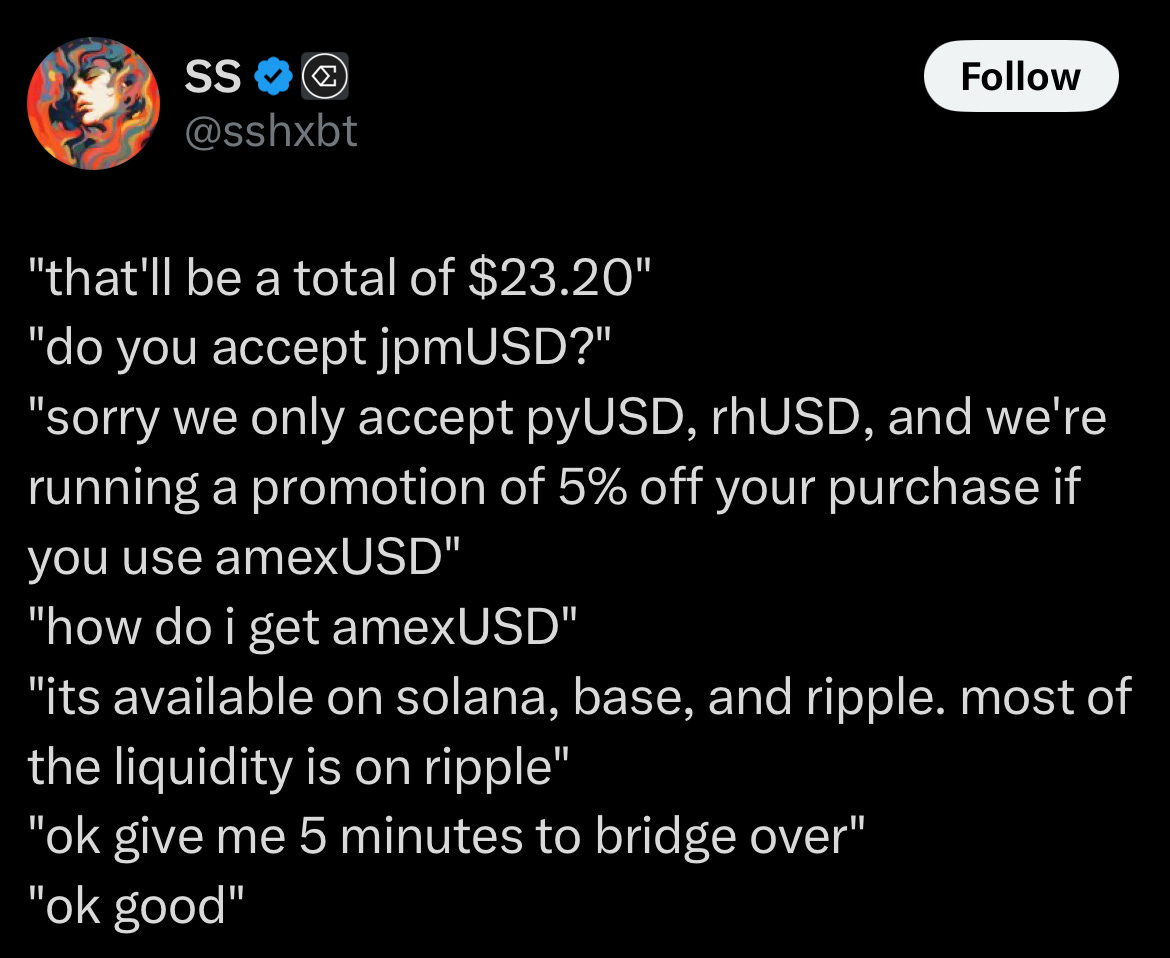

On an ironic closing note, my friend paid for Stablecon with an Amex and was told that refunds would not be possible. This irony will be unpacked at a later date

Till Next Time.