Agency Banking in Nigeria, An interesting Love Story

Cash Is King? Not Anymore - Now It’s Just Expensive

Happy Women's Month

Please do not make war plans in a group chat.

Nigeria may not qualify for the World Cup

Mercury raised a Series C round at a $3.5 billion valuation

Everyone is talking about Stablecoins

Robinhood just launched “Uber for Cash withdrawals”

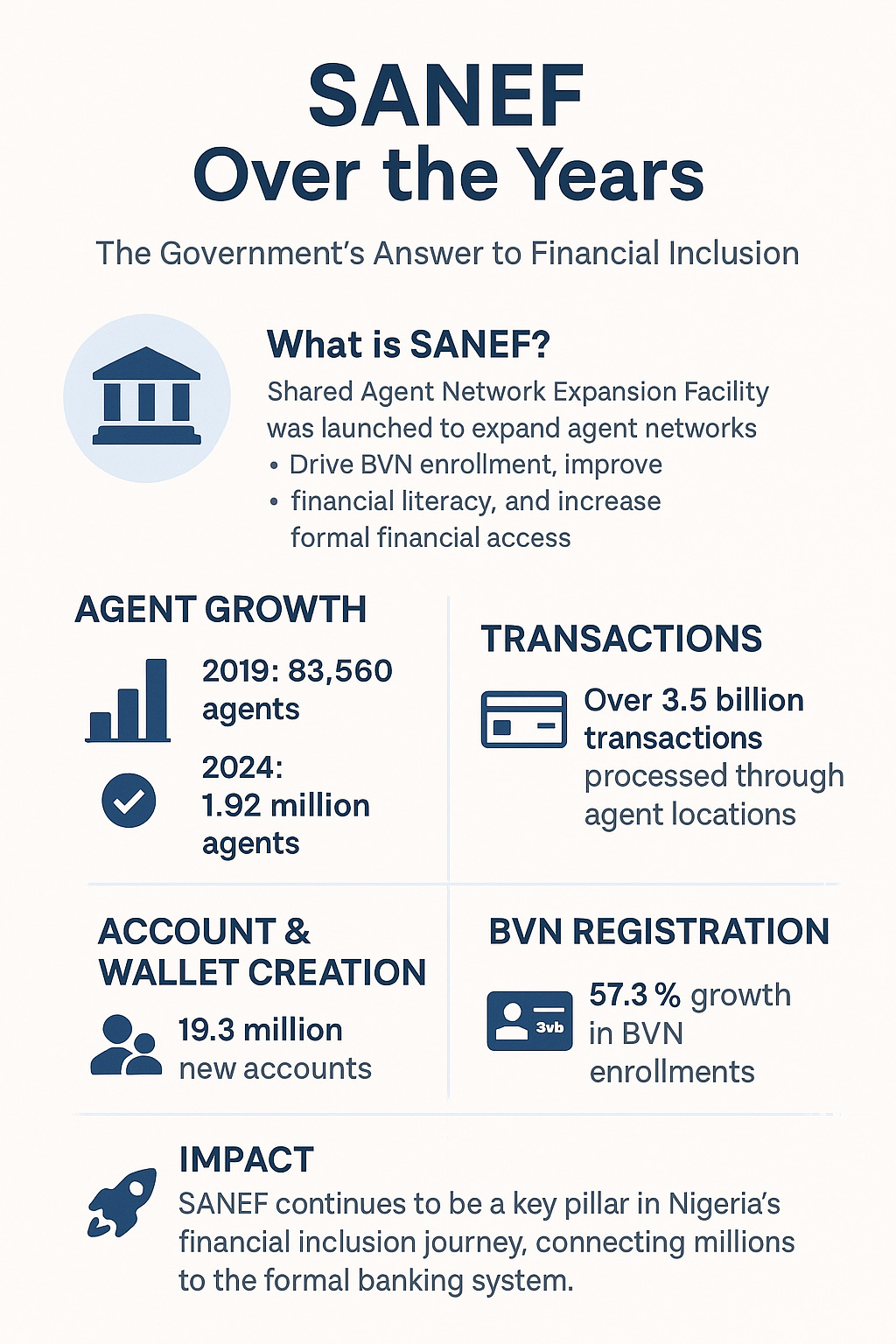

Congratulations to Uche Uzoebo on becoming the new managing director of the Shared Agent Network Expansion Facilities (SANEF) - The body established by the CBN in 2018 to drive financial inclusion in Nigeria

Nigeria’s Agency banking, POS Agent network and cashless policy journey has been littered with good intentions but executed poorly - partly because the Nigerian populace is stubborn, loves their cash, and still harbours distrust for digital products.

Context: SANEF and The Cashless Policy Dream

In 2012, the former Central Bank governor Lamido Sanusi decided that for Nigeria to be one of the top 20 global economies by 2020, we had to transition to a cashless economy, reduce naira note dependency and make digital payments the norm.

His goals included increasing alternative payment options, boosting convenience, and making tax collection easier. Another major push was to cut the massive costs of banking services. For example, the cost to keep a single ATM running costs banks between ₦2 to ₦5 million monthly.

This shift opened doors for companies like Paga and First Monie (a First Bank subsidiary) to launch agency banking networks, creating jobs for agents and increasing financial access in rural areas.

Between false starts on this policy, the introduction of BVN, and the rise of fintech, his successor at the CBN doubled down on this target, and in 2018 launched SANEF as a standalone agency with a mandate to deliver on this singular goal.

The demonetisation agenda of PM Modi in India bolstered Emiefele's resolve. He had the support of a President who campaigned on eliminating corruption and implementing a single treasury account (TSA) and was determined to achieve his goal at any cost. The bank CEOs who made up the SANEF board were going to be held accountable.

To support this push, banks had to decommission off-site ATMs, and offer specialised credit facilities and technical support to the super agents. The directive was clear: “Make a transfer or bear the cost by paying for cash

Emiefele invented the phrase “you must do transfer”. But the Nigerian consumer always has other plans

(Allegedly, there’s a graveyard full of companies who got incorporated or reincorporated for the sole purpose of collecting what they deemed free money to facilitate SANEF and agency banking activities)

Enter Opay

N power, FETS, Chams, Unified payments, 3 Line, Paga, Kudi(Nomba), IFIS(Quickteller), and Accelerex, are a few popular companies that received SANEF support and funding to become super agents and advance the cashless policy and financial inclusion agenda. While they made progress in their select rural areas, they struggled to bridge the gap between urban and rural financial access.

While I could go to a Paga agent in Nembe, or use a Nomba POS in Karu to access cash and pay in these places, I could not pay my vulcaniser, bus/keke driver or local barman in Lagos digitally, and as such the lack of urban progress was eating up the progress being made rurally.

Opay solved this problem with verticalised services such as food delivery and ride-sharing. With their acquisition of Paycom, they ensured every user in their ecosystem at the time had bank accounts which were mirror images of their phone numbers. - Simple yet effective.

Suddenly, in 2020, my local barman in Lagos, who had refused transfers for years, finally said: “Bros, you fit pay for my OPay.” That was the moment cashless payments hit home.

Moniepoint, Currency redesign, and Godwin’s Hail Mary

Fast forward to 2023, during election season. Emiefele, fresh from a failed presidential bid, decided to leave a legacy (and allegedly secure some extra cash) by redesigning the naira and banning old notes overnight. The rollout was a disaster, there were cash shortages, riots, and even deaths followed. - Money had become illegal.

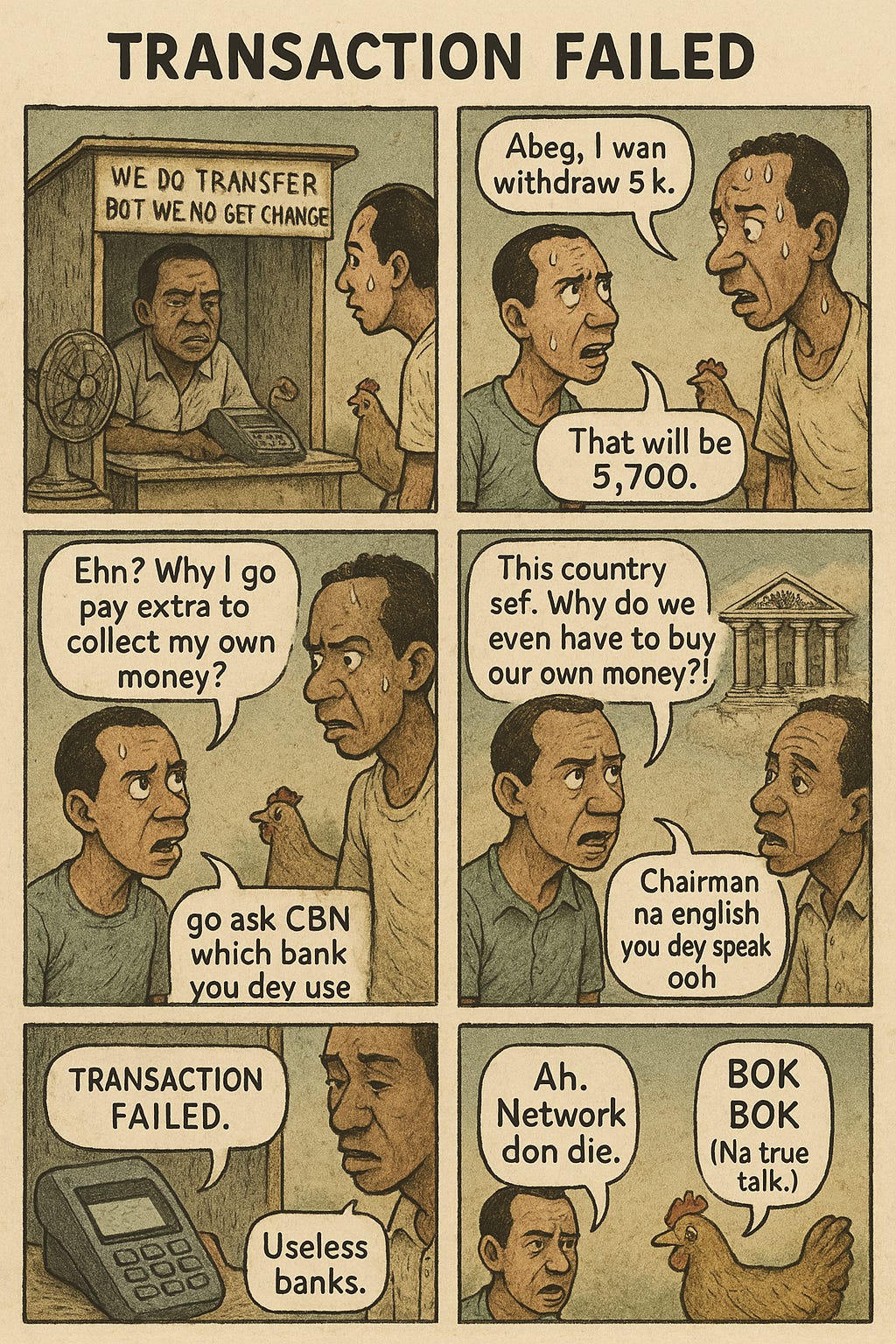

Around the same time, TeamApt rebranded as Moniepoint, expanding fully into business and consumer banking. Their POS terminals, with instant transfer confirmations, became gold. Nigerians, desperate for cash, flocked to agents, who now charged fees to withdraw money, giving birth to the infamous “Why must I pay to buy my own cash?” debate.

The Cashless Future: No Going Back

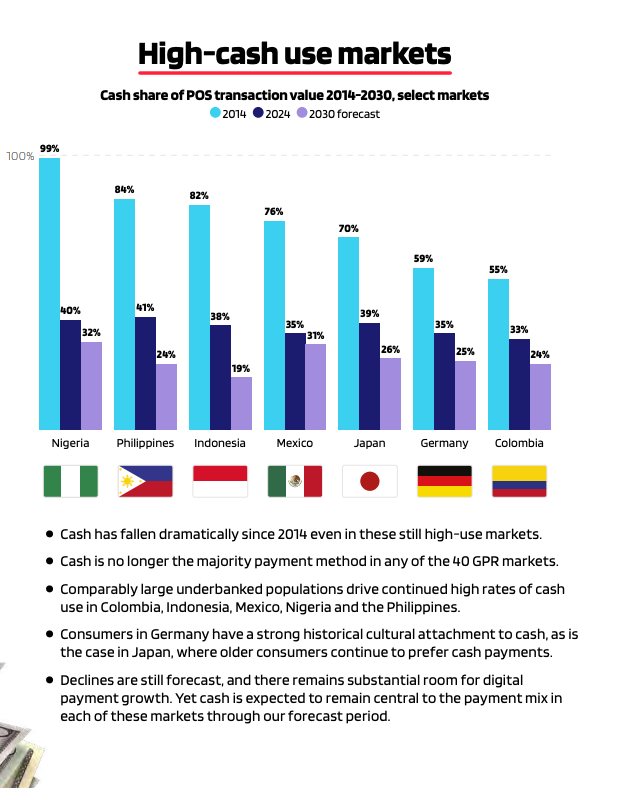

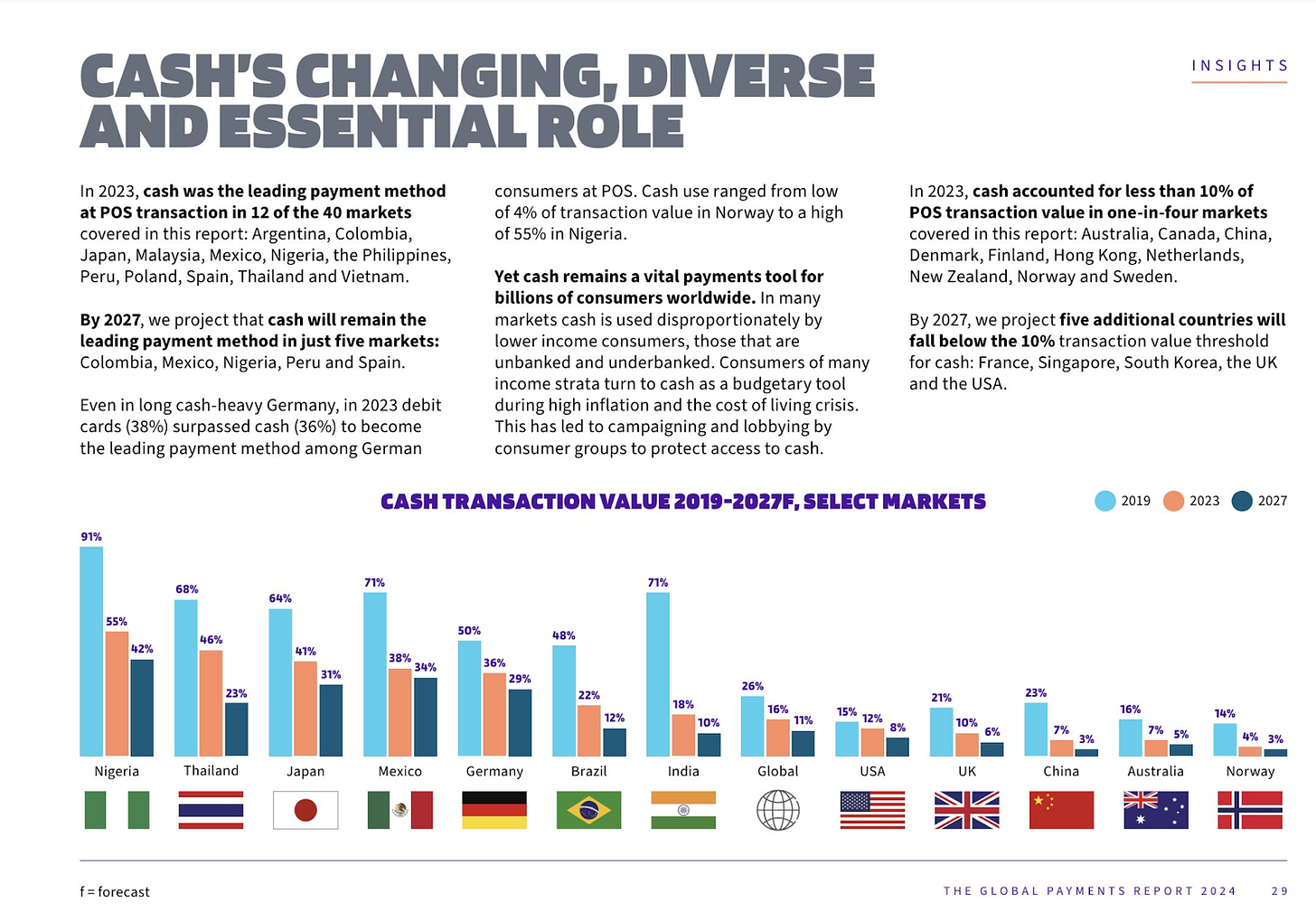

Nigeria’s cashless experiment is 13 years old, and while bumpy, more Nigerians than ever now have access to digital financial services. The data backs it up: Over 2 million direct jobs have been created, and cash dependency has dropped from 91% to 55% in just five years.

The CBN isn’t backing down. In 2025, it introduced even higher ATM withdrawal fees and new cash-handling limits for agents. The message is clear: digital transactions are the future, and cash is a premium commodity which they want to keep reducing the supply of.

The poor, whom the middle class always claims to fight for, have already adapted. They pay to access cash without complaint. Maybe it’s time you, dear middle-class Nigerian, accepted reality and got on with it. In 20 years, Emiefele might finally get his flowers for getting one thing right.

Make a transfer, or bear the cost of accessing cash. Globally speaking, there is only one outcome in this battle.

Nice article! I enjoyed reading this - particularly the chronological order it took. Really entertainment dialogue in your comic strip😅. I'm curious though - please what AI tool did you use if you don't mind me asking?