Bank Globally - Pay Locally: The real cost of creating a truly “global” (digital) bank.

While money is becoming borderless, the institutions best positioned to power this future are running out of steam.

Hello there,

Stripe added 60 new products, including what looks like Stablecoin banking in 110 countries (Nigeria and Europe excluded sadly).

We have an American Pope, He’s Peruvian, from Chicago, and went to Villanova to study maths. Long may his eminence reign.

Kevin De Bruyne is going to leave Manchester City after 10 years.

We wrote about Premium Nigerian Banking over at Notadeepdive

Circle launched a *global* payments network to take on SWIFT

Coinbase launched x402 — a new open standard for internet-native payments.

And oh, they just joined the S&P 500, replacing Discover Financial. - Some things are too scripted.

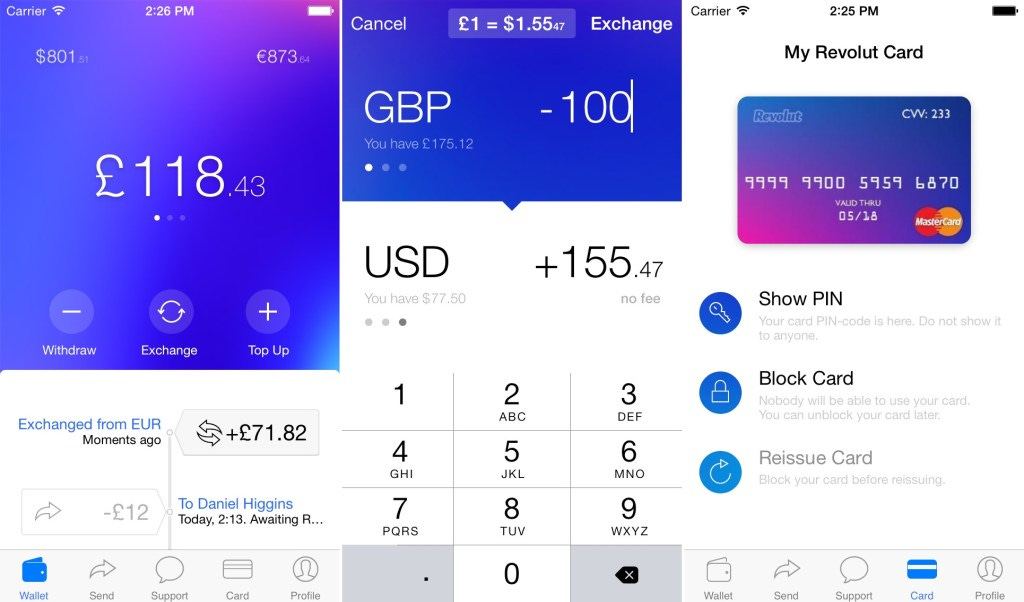

Today, let’s talk about Revolut and global banking.

“There is no shortcut to becoming a real bank. We had to build from the ground up.”

— Nik Storonsky, CEO, Revolut (2024 Annual Report)

Amid a wave of News from various Nigerian companies releasing products targeting new geographies, Revolut released its 2024 Financial results. While analysing their statements, a few lines stood out from Nik’s statement that reflected the reality of what it takes to build a truly global bank.

“Our position as a primary financial services provider continued to improve, with a 59% year-on-year increase in customers using us as their main bank. Revolut is a licensed bank in 30 countries, and is currently in the 'mobilisation' phase of the UK banking license process. We expanded local European bank issuance to 11 countries, from 4 in 2023, and we now support our customers’ ability to pay taxes in Romania, Belgium, and Spain”

Multi-currency global accounts have become the new wave of African Fintech that VCs and talent have decided to bet the house on.

As more African youth tap into the global digital economy via tech, commerce, and digital content creation, they are finding out that their local financial services providers are not fit for purpose to serve some of their needs due to domestic compliance requirements.

Financial services in 2025 are trending towards a full-stack suite. (Something our local financial institutions in Nigeria build HoldCos for)

Revolut, Wise, Nubank, Stripe, Robinhood are just a few companies attempting to solve neobanking at a global scale by plugging into multiple complementary verticals: not just remittances or payments, but cross-border money management. FX, transfers, cards, savings, wealth management, lifestyle, marketplaces, etc.

Simple in theory, brutal in execution (and even possibly illegal?)

So, how does a single financial services entity manage to bundle 20+ services(Including Tinder, the FT, airport lounges, Perplexity, and rare earth metals) and counting into a single application, serving 53 million customers in 30 countries?

A few numbers

Revolut has been profitable for the last 4 years. Impressively increasing its customer base over the last 3 years from 26 to 52.5 million customers, and growing annual revenues to £3.1 billion

With customer balances of £30 billion(for comparative context, Lloyds has £320 billion in deposits), the bulk of that growth over the last few years has come from diversifying its business offerings and expanding into lending, wealth, crypto, business, kids, commodities, stocks, selling digital subscriptions, and even e-sim verticals.

And for all these verticals, they have had to create roughly 44 different entities across the world to offer these complementary full-stack financial services, which sit in a single application. - An impossibility in these parts.

With every single line of the shareholders' letter over the years, Mr. Stronsky highlighted how they have to comply to expand across jurisdictions.

A bit of napkin math on their financials showed me that it costs them about £400 million yearly (20% of revenues) to service and maintain these multiple businesses. Despite all that, their UK banking licence is still pending, and their entry into the US is stalled.

Looking Ahead

“We continue to work towards becoming our customers' trusted primary financial services provider, simplifying all things money for the world. (2023)”

“Revolut remains poised for exponential growth. Our customer base is expanding at impressive rates year after year, and our diversified business model continues to fuel exceptional financial performance. Despite considerable scale, we are still early on our journey to simplify all things money for 100 million daily active customers in 100 countries. (2024)”

India, Brazil, Mexico, Singapore, New Zealand, South Africa; these are a few countries Revolut is in the process of increasing its offerings to.

And in all these countries, they will have to comply with respective regulatory frameworks to offer their products, even if it means reducing the scale of these offerings.

For example, despite being headquartered in the UK and having a full EU licence, they are unable to offer credit in the UK, Netherlands, Belgium, etc - Services which are available to their French, German, Italian, and Spanish users.

The African Correlation

On this side of the world, it seems there is a new company trying to solve for multi-currency accounts or remittances every new day. At this point, I believe more companies are trying to solve these problems in the African market than there are potential customers.

Yet VCs and talent alike are betting on creating more of these products that let you open USD, GBP, or EUR accounts in minutes. Some offer virtual cards. Some promise remittances. Some even throw in local market transfers and crypto.

While they create the illusion of a global financial passport, under the hood, most are not banks, and are riding on someone else’s license or Banking as a Service provider.

Just like Revolut, legally building this infrastructure requires serious gymnastics. And the average African user is not particularly loyal, as they’ll jump ship for a better rate, nicer UI, or faster KYC. While bidding their time till they can open their proper international bank accounts to signal status.

The big banks haven’t cracked real intra-Africa play. The Pan-African Payments and Settlement System (PAPPS) may end up becoming another white elephant project at this rate.

We do not share data, nor do we have harmonised KYC regimes within our borders. FX rules change overnight, as African Central Banks drive up the premium on the US dollar by flip-flopping on policies.

Revolut only has to deal with one EU regulator when expanding within Europe, but LemFi, Moniepoint, Kuda, Grey, Hurupay, Eversend, and a host of others have to deal with 54 different regulators in Africa. Many of the African regulators don’t even have open APIs or clear licensing regimes.

Revolut’s key innovation is finding a way to reduce complexity for users by bundling all their licences and services into a single interface rather than multiple apps.

In Nigeria, a remittance platform can’t hold deposits.

A bank cannot do remittances.

A PSB or PSSP can’t lend or manage treasury.

It does not matter if you have all the licences required for these adjacent functions; you must choose one or do the unsexy work of having multiple products and platforms to provide that delightful experience you dream of and the market yearns for.

If it has taken Revolut 10 years and 40+ licences to go from a multi-currency card to a primary global lifestyle financial services provider (aka Bank) to some of their customers, how long would it take today's remittance or multi-currency account providers from Africa to do the same?

Would the VCs funding these bets have the patience? Would the upwardly mobile target customers stick around to find out? After all, they can always grab their passports and exit the continent to where they can have bank accounts with prestigious institutions at most, or access a Revolut/Wise/Robinhood account at the minimum.

Over to the regulators to create a framework for the 21st century of neobanking in Africa. - Seamless financial services for a continent where cross-border remittances, global banking and diaspora connections are economic lifelines.

The old banks aren’t built for a world where money moves across borders in seconds, and the new ones do not have enough licences and capital to pull it off.

At this point, let's ask Revolut to purchase a Nigerian banking licence.