2025 - The year of GENIUS

Describe 2025 in 5 words: AI, AI, AI, Regulation, Stablecoins

Another year-in-review article to cap off 2025.

As usual, we started this year with a list of predictions on what we expected to see in the market, writing eight newsletters here and four for Notadeepdive.

Across various topics like VC investing, the grey list, global banking, local payments, agency banking, premium banking services, and everyone’s favourite topic - stablecoins.

Looking back at the predictions at the start of the year, I can take a victory lap for accurately nailing five predictions.

And now let’s briefly review some of the highlights and themes of the year.

The CBN

Mr. Yemi Cardoso had a solid year that proved even his strongest critics wrong on all but two categories within his remit.

Following up on his promises at the 2024 Bankers’ Committee dinner, he doubled down on imposing various forms of regulation to clean up and open up the financial markets.

Notable moves included:

Approving the Open Banking framework for implementation

Raining on Paystack’s Zap launch with a hefty fine

Fighting fraud with multiple memos

Creating a new draft on banking adverts

Reviewing the agency banking model by creating an overhauled POS guideline. Acknowledging that Cash availability is a better strategy to fight against third-party fraud.

Launching the National Payments Stack and updating the international messaging standard for bank transfers and POS payments

Finally getting Nigeria off the Grey list

It appears that everyone in the ecosystem had to become a compliance expert this year, as various pieces of regulation were released monthly to combat fraud, agent banking abuse, and promote a cashless policy. Companies with in-house compliance depth outperformed those that outsourced thinking to consultants.

The only chink in his scorecard for 2025 would be the needless Fintech Regulatory Commission Bill, which would add another layer of oversight and financial burden to the ecosystem, and the expose by Tigran Gambaryan of his ordeal with Nigerian authorities.

Trends - FX, Remittance, Multi-Currency Wallets, Survival

Nigerian Naira cards can finally be used to shop globally again, so virtual card providers have to provide a new form of utility.

FX became a commodity - just like we predicted, every remittance and multicurrency wallet player commoditised their FX offerings onto the market, as that was the only thing the VCs wanted to fund.

Raenest Lemfi, Kredete, and Yyenza went a step further by raising significant sums of money to advance and test out their various implementations of a remittance + credit model for immigrants in the diaspora

And PAPSS launched a card this year to continue strengthening its pan-African network capabilities

Cloud computing remains an essential commodity in these parts. Amazon and MTN made a big show of charging in Naira and building more cloud infrastructure closer to the market, while Okra, the Open banking + cloud startup, shut down.

There was no local IPO this year, despite global fintech appetite, with the IPOs of Chime, Circle, Klarna, Wealthfront and the Nigerian government trying to woo them to list on the NGX. No pressure folks

Moniepoint rounded up a slow year of fundraising with a $90 million series C extension to expand their Remittance and Inventory management play

Chowdeck also acquired Mira for an undisclosed sum, consolidating the inventory management capabilities of both entities

And Chowdeck and PaidHR flirted lightly with expanding their fintech capabilities because bill payments and airtime are proven low-hanging fruits that everyone with distribution can latch onto their existing product.

Zap was a well-designed product primed to serve the local and diaspora market, but regulatory concerns and trademark issues affected its launch

And many remittance and FX players did their best to market their products to the diaspora in time for December.

Crypto and AI

When the year started with Donald Trump legalising rugpulls with the launch of his $Melania and $Trump tokens, setting the stage for the interesting year in crypto we were going to have.

The GENIUS Act, being passed by the US, meant that crypto and mostly stablecoins became legal within appropriate frameworks. Various traditional companies accelerated their crypto roadmaps due to this piece of regulatory clarity.

Circle had their IPO, Coinbase, Fireblocks, Moonpay, Kraken, Ripple, all made acquisitions, Visa continued to expand and blur the lines between stablecoins and a card network, and Stripe backwards integrated by acquiring Valora.

Google, Coinbase, Circle, and Stripe also created new stablecoin networks with Stripe seeding Tempo - A rebrand of Mark Zuckerberg’s Libra

Almost every fintech deal or YC batch this year teased stablecoin payments for the world, despite these companies being headquartered in New York

Western Union and Flutterwave also teased a Stablecoin offering to complement their product suite.

And PayPal and Paxos wanted us to applaud them for immediately catching and cancelling the erroneous minting of $300 trillion in their network.

Agentic Payments became the new hot word as the industry scrambled for a killer AI use case. Now you can shop on your favourite marketplaces, book vacations, or order food in Chat GPT in collaboration with Stripe, Shopify and many more partners.

Cluely and Poke re-invented rage baiting, while trying to sell products that allowed people to cheat on everything, and two books on Sam Altman and OpenAI came out

Every AI lab tried to launch a browser, allowing the company behind Jira to buy up the best AI-enabled (agentic) browser in the market for a healthy exit.

It’s funny and ironic to me that we spent the last 15 years of payments trying to prevent bots from performing commercial transactions on the internet. Yet with stablecoins and AI, it seems that the next two years of work for most of us would be enabling agents and bots to spend for us in a “safe, secure, programmable” manner. Good luck.

Global Fintech

Chime, Klarna, Circle and Wealthfront had relatively successful IPOs this year, with Revolut, Airwallex, Ramp and Deel raising significant amounts in blockbuster deals.

N26, Monzo and Worldline found themselves in regulatory hot water for various reasons this year, leading to leadership changes

Jamie Dimon decided to flex his emperor muscles, almost killing Open Banking, leading to 80 CEOs petitioning the US president to intervene.

The OCC somehow approved the trust bank applications of Ripple, Fidelity, Paxos, BitGo, and Circle while rejecting that of Stripe and extending the review period for that of PayPal. Nothing to see here, just a regular day of the crypto super PAC running the greatest country on earth.

Retail investors learned a bit about the institutional IPO process by being priced out of the Figma IPO allocation.

And Gambling has been rebranded to prediction markets, giving insiders a way to legally trade on insider information, go scott free and manipulate markets in the process.

(Please listen to this video of Brian Armstrong (CEO of Coinbase) manipulating the market in real time, which even Polymarket - the leading prediction market in the world called “diabolical work”.)

End of Year Awards

Winners:

Tesla Shareholders

The richest man in the world started the year as the CEO of 5 companies and the head of DOGE to boot, while Tesla shareholders felt like the oft-ignored first wife of a polygamous marriage, despite most of his wealth stemming from Tesla.

They have managed to get his attention and also secure their financial fortunes by negotiating a blockbuster pay package that will see him become a trillionaire in the future if he delivers incremental $7 trillion of value and delivers 20 million new cars over the next 10 years.

This deal ensures everyone benefits from the upside, and he pays more attention to Tesla.

Deals like this replicated themselves during the year as OpenDoor poached the COO of Shopify in a similar deal, and OpenAI signed a performance deal with AMD structured the same way.

The Trump Family

#47 ran his campaign on as a self-proclaimed deal maker, knocking off Sam Altman as the king of self-dealing this year.

His son Barron runs World Liberty Financial, the vehicle behind the $Melania and $Trump rug pulls.

They secured sizeable donations from the Pro-Crypto super PAC and passed the GENIUS Act.

There are rumours that World Liberty Financial may have profited by taking market positions before every single tariff announcement, and he closed the year by being named FIFA’s president of peace.

Jensen Huang

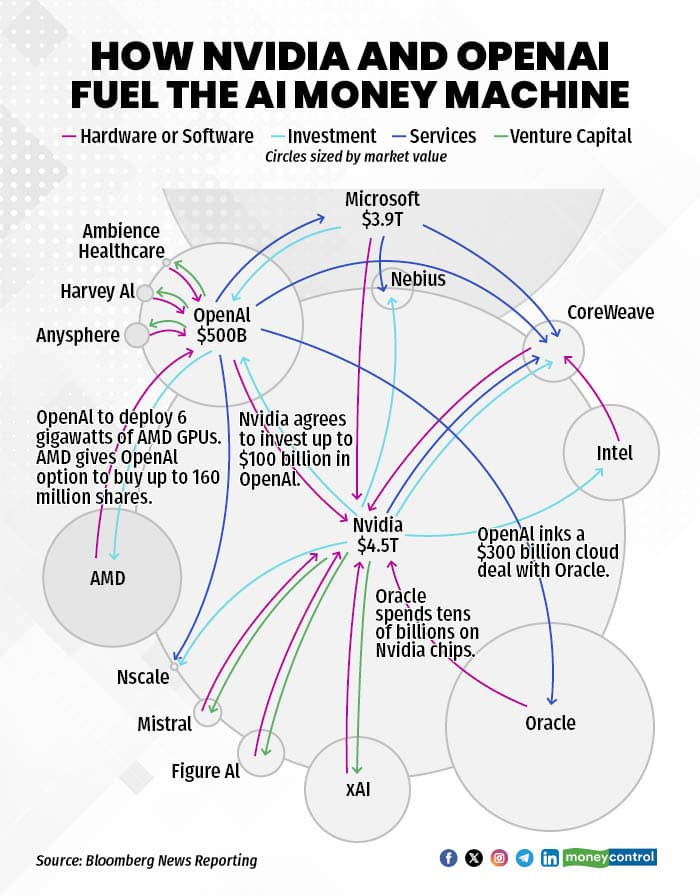

NVIDIA became the first company in history to hit a $5 trillion valuation fueled by the AI boom and the continued sale of their chips, which power the large-scale training and inference required to run these AI models from the various frontier labs all over the world. With the ban on the sale of NVIDIA GPUs to China now lifted, he is set for an even more stellar year. That’s if this house of cards do not crumble.

Google

Google, on the other hand, since the return of Sergey Brin, has been on a tear, releasing high-quality products and closing the gap in both model and product quality between them and OpenAI.

The masses love their Nano Banana, NotebookLM, and Gemini keeps getting better and better. It helps having the highest concentration of PhDs and Nobel Prize winners in a tech company after all. And search ads and YouTube have never been stronger.

The Lawyers at Stripe

Stripe had 3 acquisitions this year, closed a tender offer round, seeded Tempo to test out their own blockchain network in partnership with 26 different partners, started issuing stablecoin cards via Bridge, applied for a banking license, lost their banking license application, got into regulatory hot water in Nigeria, and terminated the employment of the co-founder of a subsidiary, all in one year. - Wow, that’s a mouthful.

The lawyers at Stripe can’t wait for the year to be over and the billable bonuses they will earn from all these activities.

Stablecoins

Stablecoin players finally realised that they could get institutional acceptance and utility by being the underlying infrastructure to usher financial services into a new future, rather than trying to compete on the consumer side.

This has led to the entire stablecoin ecosystem maturing and pushing past $4 trillion in payment volume for various B2B, cross-border, settlement, and treasury use cases across the world.

Compliance Experts

With the CBN dropping 14+ regulatory policies throughout the year, covering everything from Open Banking to POS geo-tagging, fraud prevention to marketing restrictions, compliance officers became the most important hires in financial services.

Law firms, compliance consultancies and Boutique regulatory advisory shops have had a stellar year, while companies have learnt to build compliance muscle in-house to ensure their survival.

Losers:

Real economy

The stock markets are largely being held up by a bucket of 7 stocks with AI leanings, while the real economy suffers, employees are being laid off, and the cost of groceries seems to keep rising.

But hey, as long as Sam Altman can pull off a deal out of his hat that ensures the same $300 billion flows through the same 7 companies, we can applaud the economy as winning.

Employees

Employees are being replaced by AI at a significant scale across many industries, as leaders have all priced in the cost-benefit of announcing an AI initiative, coupled with layoffs will juice up stock prices and executive compensation.

POS Agents

The CBN’s new agency banking guidelines have created a barrier to entry for the POS agent market. The 10-meter radius geo-tagging requirement, coupled with the exclusive principal relationship and the new cash in cash-in-cash-out limits, all imply that agents can no longer roam freely with their terminals, or own an unlimited number of terminals across various providers to optimise their returns flexibly.

Person of the year

Lina Khan

Roomba maker iRobot shut down this week. Famously, they were to be acquired by Amazon for $1.7Billion, but that acquisition was blocked by Khan and the FTC.

Employees at Windsurf and Scale AI also have no love lost for her, as the increased antitrust sentiment during her tenure meant they could not be acquired by Google and Meta, respectively.

While their CEOs and investors just walked to these new bigcos, leaving these companies to be empty shells of themselves.

Imagine hearing in the news that your company is to be acquired by OpenAI, Google or Meta, only to then be told that only the CEO and key leaders will be part of the acquisition due to antitrust concerns? Yeah, that sucks.

She took her victory lap when the Figma IPO happened, and with another major acquisition in Netflix-Paramount-WB looming, the ghosts of Lina Khan will torment every future M&A transaction.

Thanks to everyone who has read, shared and given feedback on some of the things written here this year.

The most viewed post for the year was on agency banking.

Merry Christmas, and see you in 2026.

As a Christmas present, watch this 13-second video on the state of AI

A Few nice links

52 Things I learnt in 2025 - Tom Whitwell

Math of why you can’t focus at work - Can Duruk

There is no substitute for thinking - Nick Maggiulli

False Futures - Abdulhamid Hassan

Hope is the strategy - Fintech Takes

The hidden banking layer behind stablecoin payments - Stabledash

Is it a Bubble? - Howard Marks

Wealth Is What You Don’t See - Morgan Housel

My guy, more ink.

Nice!